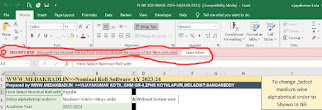

*TS INCOME TAX SOFTWARE FROM MEDAKBADI FOR FY 2025-26 (AY 2026-27) Final version 06.02.2026

*AP INCOME TAX SOFTWARE FY 2025-26 (AY 2026-27) Final Version 04.02.2026

Salaried taxpayers can switch between the old and new tax regimes annually during e-filing (ITR filing), regardless of the option chosen for TDS earlier in the financial year, allowing them to select the more beneficial, lower-tax option

Medakbadi has released a user-friendly trail version Excel-based Income Tax Calculator tailored for the financial year 2025–26, specifically designed to meet the needs of Telangana government employees.

🔹 It automatically selects the more beneficial option between the Old and New Tax Regimes based on the selected mode in the ‘Auto Selection’ section of in the data sheet of excel software.

🔹 Key Features:

- Supports both Old and New Tax Regimes

- Auto-calculates rebates, deductions, and cess

- Includes salary components, savings, and exemptions

- Easy to use on desktop or mobile (Excel-compatible apps)

🔹 Why Use It?

- Ensures accurate tax computation

- Saves time during Form 16 preparation

- Helps in planning investments and Advance Tax Deductions

📢 use this calculator to finalize your tax details and share this link 👉 Income tax Software FY 2025-26 Trail

Final version prepared in the month of Jan-2026

If you find any errors, comment below — I’ll rectify them soon

AP INCOME TAX SOFTWARE FOR FY 2025-26 (AY 2026-27) PLEASE

ReplyDeletePls upload AP INCOME tax software

ReplyDeleteplease update for ap also sir

ReplyDeleteTHANKS ALOT BROTHER FOR YOUR WORK AND SUPPORT

ReplyDeleteplease update for ap also sir

ReplyDeleteAP INCOME TAX SOFTWARE PLEASE

ReplyDeleteAP INCOME TAX SOFTWARE PLEASE

ReplyDeleteAvailable, check

Deleteedit password please

DeleteGOOD MORING SIR I AM USING UR SALARY BILL SOFTWARE BUT I AM TRYING PRINT EXCEL IT IS RESTRICED TO UPTO AA ONLY

Deletein it software edit password pl

ReplyDeleteThankyou Brother, edit password please..

ReplyDeleteedit password please Send Sir

ReplyDeletegood morning sir, please provide excel sheet multiple staff income tax calculator (checking purpose)

ReplyDeleteplease update new da (33.67%) in income tax 2025-26....

ReplyDeletelet out undi, housing loan unna vallaki u/s 24(B) lo interest loss ga chupinchavachhu kadha sir e software lo include ela cheyyali

ReplyDeleteHouse Property Income – New Tax Regime

Delete1. Rental Income

- Rental income (Gross Annual Value) is taxable under “Income from House Property.”

- From this, you can deduct:

- Municipal taxes actually paid

- Standard deduction of 30% (Section 24(a))

2. Interest on Housing Loan

- Under the new regime, interest deduction (Section 24(b)) is not allowed.

- This means you cannot reduce your taxable income by claiming housing loan interest, even if it creates a loss.

3. Loss Treatment

- If interest exceeds rental income, the resulting loss cannot be set off against salary or other income.

- The loss can only be carried forward for 8 years and adjusted against future house property income.

📊 Example

Suppose:

- Gross Salary = ₹16,00,000

- Rent (after municipal tax) = ₹2,00,000

- Standard Deduction (30%) = ₹60,000

- Net before interest = ₹1,40,000

- Loan Interest = ₹2,50,000

Old Regime:

- Net House Property = ₹1,40,000 – ₹2,50,000 = –₹1,10,000 (Loss)

- You could set off up to ₹2,00,000 against salary. Taxable salary = ₹14,90,000.

New Regime:

- Net House Property = –₹1,10,000 (Loss)

- This loss cannot be set off against salary.

- Taxable salary remains ₹16,00,000.

- Loss of ₹1,10,000 is carried forward to future years, usable only against house property income.

✅ Key Takeaway

- Standard deduction (30%) is allowed in both regimes.

- Interest deduction is allowed only in the old regime.

- In the new regime, house property loss is carried forward, not set off.

This comment has been removed by the author.

ReplyDeleteUpdate new DA in TS Income software 33.67%

ReplyDeletesir..plz update new DA in IT software

ReplyDeleteTHANK YOU FOR YOUR UPDATED NEW DA

ReplyDeletesir please upload ap tax software 2025-26

ReplyDeleteSIR PLEASE UPDATE HRA CHANGE ,IT IS NOT REFLECTED

ReplyDeleteEnter the HRA change date in cell N13, and then select cell N15 to input the required HRA percentage

DeleteSir D.A. installments edit option not given and 26.39% D.A. option not given

ReplyDeleteSir,In the third row in D.A Column of DATA Sheet, enter the D.A. arrears amount only if those arrears have actually been credited to the employee’s account.

Deletesir how enter amount at entertainment allowance 16(ii)

ReplyDeleteSir,You may directly enter the Entertainment Allowance under Section 16(ii) in Annexure , cell 18

DeleteSir, e tds filing ela cheyalo cheppagalaru

ReplyDeleteSir,There is a video on Medakbadi explaining how to do e‑TDS free of cost by using the TDS software prepared by Medakbadi.

Deletesir,

ReplyDeletehow to claim home loan deductions in New Tax Rezim.

sir what about section 10(10AA)

ReplyDeleteSIR NEW REGIM LO HOME LOAN INTEREST DEDUCT AVUTHUNDA

ReplyDeleteYes, But to declare your house as a let-out property (rented property) for official or tax purposes, you generally need to follow these steps:

Delete1. Rental Agreement

- Prepare a written rental/lease agreement between you (the owner/landlord) and the tenant.

- Include details such as rent amount, duration, tenant’s name, and terms of use.

- Get it signed by both parties, and ideally registered with the local sub-registrar office.

2. Rent Receipts

- Issue monthly rent receipts to the tenant.

- These serve as proof that the property is actually let out.

3. Declaration in Income Tax Return

- In your Income Tax Return (ITR), declare the property as "Let Out."

- Report the annual rental income received.

- You can claim deductions such as:

- Municipal taxes paid

- Standard deduction of 30% on Net Annual Value

- Interest on home loan (if applicable)

4. Local Authority Records

- Update municipal/property tax records if required, showing the property is rented.

- Some states/municipalities ask for tenant details for record-keeping.

5. Supporting Documents

Keep ready:

- Registered rental agreement

- Rent receipts

- Bank statements showing rent credited

- Property tax payment receipts

Interest on Housing Loan in new tax regime

DeleteNo Interest Deduction: In the new tax regime, you cannot claim housing loan interest under Section 24(b).

- No Set-off: If interest is more than rental income, that loss cannot be adjusted against salary or other income.

- Carry Forward Only: Such loss can only be carried forward for 8 years and used against future house property income.

👉 In simple terms: Housing loan interest doesn’t reduce taxable income in the new regime. Losses from house property can’t be set off, only carried forward.

PLEASE EDIT OPTION DDO PAN TS INCOME TAX SOFTWARE

ReplyDeleteSir check

DeleteGood afternoon, Sir. In the Telangana Income Tax software, the edit option for DDO PAN is not appearing.

ReplyDeleteSir, TS income tax lo DDO Pan daggara edit option ravatledu.

ReplyDeleteSir ,unprotected cell, check

DeleteSir please add or edit AAS date for 2019.10.30(2017-TRT)

ReplyDeleteSir,It will not be reflected in the salary statement from March 2025 to February 2026; only in the D.A. arrears be shown

Deletehow to show DA Arrears in which column??

ReplyDeleteEls Aount not appear in the statement sir

ReplyDeleteSir enter in other arrears

Deletesir,

ReplyDeleteit is not showing 10E relief in new tax regime .please check it and reply sir

Select “Yes” in cell E58 of the data sheet and enter the required details below. Then go to the Form 10E sheet to ensure that any relief calculation appears under Section 89(1). Only that amount will be deducted

DeleteSelect “Yes” in cell E58 of the data sheet and enter the required details below. Then go to the Form 10E sheet to ensure that any relief calculation appears under Section 89(1). Only that amount will be deducted

ReplyDelete